Greece set to ‘do the right thing’, yet the numbers don’t add up

Published:

The scale of Greece’s financial crisis has finally reached a nadir on the streets, more than five years on from their initial Eurozone/International Monetary Fund rescue package being sanctioned, with banks closed until July 6th at the earliest and ATMs emptied of cash.

Prime Minister Alexis Tsipras and finance chief Yanis Varoufakis have split opinion worldwide with their decision to walk out on Friday’s talks and call a snap referendum on whether to accept the latest austerity measures demanded by the country’s creditors.

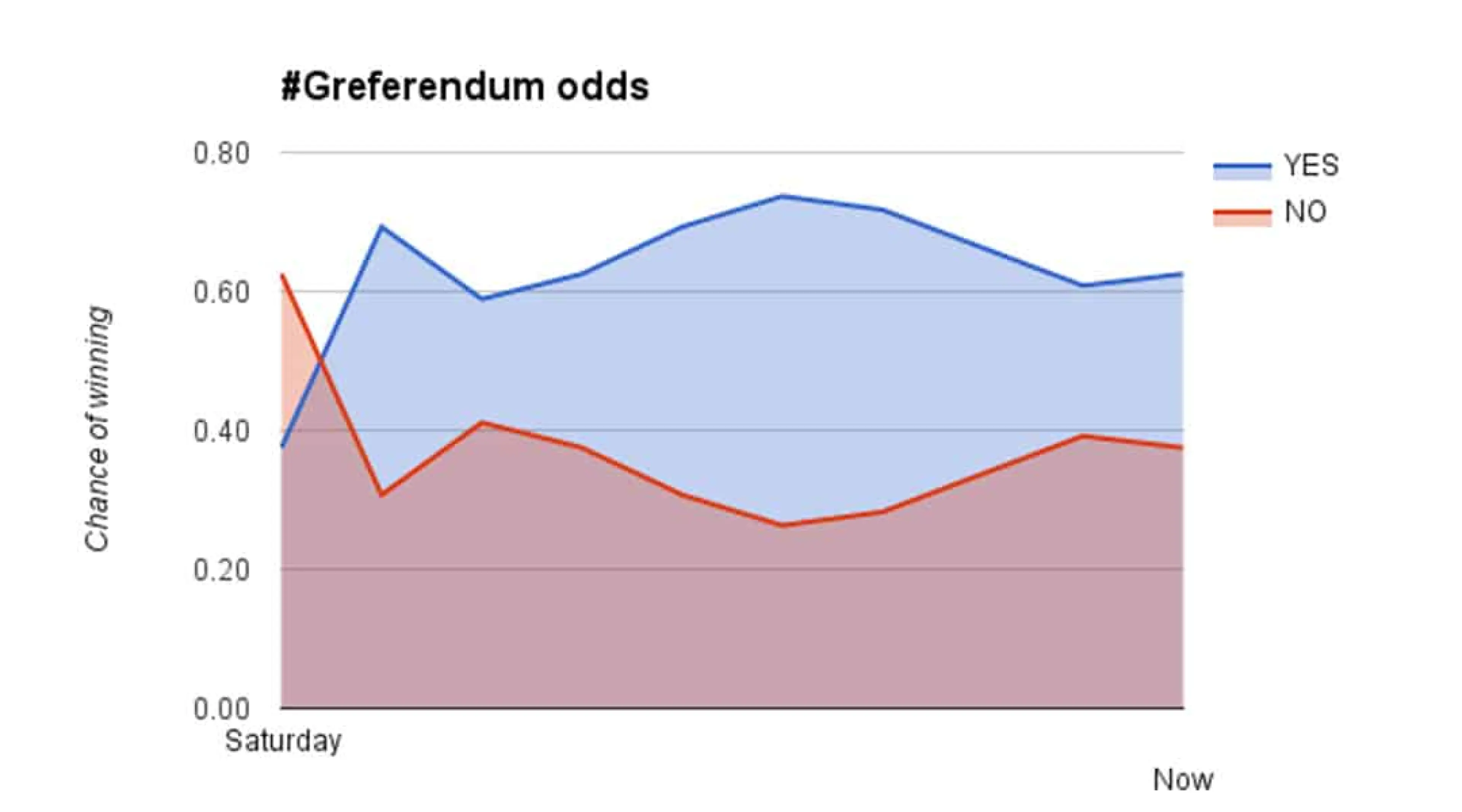

It looks good for European Unionists, judging by the movement in Ladbrokes’ betting markets since Tsipras announced the referendum. A ‘Yes’ vote is currently favourite at 4/9, with ‘No’ at 13/8.

Notwithstanding the fact that the PM will, in all likelihood, have to resign if his people vote yes, having campaigned for no, Greece’s problems are set to come back with a vengeance as July unfolds, whether there’s a change in government or otherwise.

The nonsensical pyramid scheme that’s keeping the world’s oldest civilisation afloat means they’ll be dragged back to the negotiating table to thrash out fresh terms after more missed payments as the month progresses.

Leaving aside €100m here and €100m there needed for interest, Greece are due to pay €3.5bn to the European Central Bank in three weeks time. If they default, the ECB, IMF and EU will find themselves in legal (and frankly moral) difficulty keeping their biggest source of trouble solvent.

The previously unspoken suggestion that Greece leaving the Eurozone would be a good thing seems to have reached a tipping point, with generally sensible Times columnist Tim Montgomerie stating yesterday:

“In the immediate term, Grexit would be painful. But since Greece currently has capital controls on its banks and limits on bank withdrawals, the additional pain of leaving is much smaller than it was. Freed of debt, with a cheaper currency and with much greater policy freedom, the economy would doubtless soon recover.”

Does this paint too rosy a picture? It’s impossible to predict, but with Bloomberg currently running a piece suggesting there’s an 85 per cent chance Greece will have to leave the Eurozone in the next few weeks, we could end up finding out soon enough.

The EU will fight tooth and nail to keep it together, but the single currency lasting in its current form is hard to imagine.

All Odds and Markets are correct as of the date of publishing.

Fancy a flutter? Sign up today to claim up to £25 in free bets.